SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934 (AMENDMENT NO. )

Filed by the registrant þ

Filed by a Party other than the registrant ¨

Check the appropriate box:

| ¨ | Preliminary proxy statement | |||

| ¨ | Confidential, for Use of the Commission Only (aspermitted by Rule 14a-6(e)(2)) | |||

| þ | Definitive proxy statement | |||

| ¨ | Definitive additional materials | |||

| ¨ | Soliciting material pursuant to Rule 14a-12 | |||

BELDEN INC. | ||||

| (Name of Registrant as Specified in Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of filing fee (Check the appropriate box): | ||||

| þ | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

(1)

| Title of each class of securities to which transaction applies:

| |||

(2)

|

Aggregate number of securities to which transaction applies:

| |||

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

(4)

|

Proposed maximum aggregate value of transaction:

| |||

(5)

| Total fee paid:

| |||

¨

|

Fee paid previously with preliminary materials.

| |||

¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

(1)

| Amount previously paid:

| |||

(2)

|

Form, schedule or registration statement no.:

| |||

(3)

|

Filing party:

| |||

(4)

|

Date filed:

| |||

April 15, 20146, 2016

Dear Stockholder:

I am pleased to invite you to our 20142016 Annual Stockholders’ Meeting. We will hold the meeting at 12:30 p.m. central time on Wednesday,Thursday, May 28, 201426, 2016 at the Four Seasons Hotel St.Saint Louis, Mississippi Room, 8th Floor at 999 North 2nd Street, St.Saint Louis, Missouri.

Consistent with past practice, we are pleased to be taking advantage of the U.S. Securities and Exchange Commission rule allowing companies to furnish proxy materials to their stockholders primarily over the Internet. We believe that this e-proxy process has expedited stockholders’ receipt of proxy materials, lowered the associated costs, and conserved natural resources.

On April 15, 2014,6, 2016, we began mailing our stockholders a notice containing instructions on how to access our 20142016 Proxy Statement and 20132015 Annual Report and vote online. The notice also included instructions on how to receive a paper copy of your annual meeting materials, including the notice of annual meeting, proxy statement and proxy card. If you received your annual meeting materials by mail, the notice of annual meeting, proxy statement and proxy card from our Board of Directors were enclosed. If you received your annual meeting materials via e-mail, the e-mail contained voting instructions and links to the annual report and the proxy statement on the Internet, which are both available athttp://investor.belden.com/financialDocuments.cfminvestor-relations/financial-information/latest-financials/default.aspx.

The agenda for this year’s annual meeting consists of the following items:

Agenda Item | Board Recommendation | |

1. Election of the | FOR | |

2. Ratification of the | FOR | |

3. Advisory | FOR | |

4. Amendment and Restatement of the Belden Inc. 2011 Long Term Incentive Plan | FOR |

Please refer to the proxy statement for detailed information on the proposals and the annual meeting. Your participation is appreciated.

Sincerely,

John Stroup

President and Chief Executive Officer

BELDEN INC.

1 North Brentwood Boulevard,

15th Floor

St.Saint Louis, Missouri 63105

314-854-8000

NOTICE OF 20142016 ANNUAL STOCKHOLDERS’ MEETING

AGENDA

| ||

| 2. | ||

|

| 3. | ||

|

| 4. | To amend and restate the Company’s 2011 Long Term Incentive Plan |

| 5. |

|

WHO CAN VOTE

You are entitled to vote if you were a stockholder at the close of business on Thursday, March 31, 2016 (our record date).

FINANCIAL STATEMENTS

The Company’s 2016 Annual Report to Stockholders, which includes the Company’s Annual Report on Form 10-K, is available on the same website as this Proxy Statement. If you were mailed this Proxy Statement, the Annual Report was included in the package. The Form 10-K includes the Company’s audited financial statements and notes for the year ended December 31, 2015, and the related Management’s Discussion and Analysis of Financial Condition and Results of Operations.

By Authorization of the Board of Directors,

Brian Anderson

Senior Vice President-Legal, General Counsel and

Corporate Secretary

Saint Louis, Missouri

April 6, 2016

| DATE: | Thursday, May 26, 2016 | |

Four Seasons Hotel Saint Louis, Mississippi Room, 8th Floor, 999 North 2nd Street, Saint Louis, Missouri 63102 | ||

VOTING

Please vote as soon as possible to record your vote promptly, even if you plan to attend the annual meeting. You have three options for submitting your vote before the annual meeting:

|

| |||||

| Internet | |||||

|

| |||||

By Authorization of the Board of Directors,

Kevin Bloomfield

Senior Vice President, Secretary and General Counsel

St. Louis, Missouri

April 15, 2014

PROXY STATEMENT FOR THE

20142016 ANNUAL MEETING OF STOCKHOLDERS OF

BELDEN INC.

To be held on Wednesday,Thursday, May 28, 201426, 2016

| 35 |

| 36 | |||||||

| 36 | |||||||

| 37 | |||||||

| �� | 38 | ||||||

| 41 | |||||||

ITEM IV – AMEND AND RESTATE THE BELDEN INC. 2011 LONG TERM INCENTIVE PLAN | 42 | ||||||

| 42 | |||||||

| 43 | |||||||

| 43 | |||||||

| 43 | |||||||

| 45 | |||||||

| 45 | |||||||

| 45 | |||||||

| 47 | |||||||

| 47 | |||||||

| 48 | |||||||

Treatment of Awards Upon Disposition of a Facility or Operating Unit | 48 | ||||||

| 48 | |||||||

| 48 | |||||||

| 48 | |||||||

| 49 | |||||||

| 49 | |||||||

| 50 | |||||||

EQUITY COMPENSATION PLAN INFORMATION ON DECEMBER 31, | |||||||

Beneficial Ownership Table of Directors, Nominees and Executive Officers | |||||||

Beneficial Ownership Table of Stockholders Owning More Than Five Percent | |||||||

| 55 | |||||||

| I-1 | |||||||

APPENDIX II – AMENDED AND RESTATED BELDEN INC. 2011 LONG TERM INCENTIVE PLAN | II-1 | ||||||

Internet Availability of Proxy MaterialsINTERNET AVAILABILITY OF PROXY MATERIALS

Under rules of the United States Securities and Exchange Commission (SEC), we are furnishing proxy materials to our stockholders primarily via the Internet, instead of mailing printed copies of those materials to each stockholder. On April 15, 2014,6, 2016, we began mailing to our stockholders (other than those who previously requested electronic or paper delivery) a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy materials, including our proxy statement and our annual report. The Notice of Internet Availability of Proxy Materials also instructs you on how to access your proxy card to vote through the Internet or by telephone.

This process is designed to expedite stockholders’ receipt of proxy materials, lower the cost of the annual meeting, and help conserve natural resources. However, if you would prefer to receive printed proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials. If you have previously elected to receive our proxy materials electronically, you will continue to receive these materials via e-mail unless you elect otherwise.

CONTACT INFORMATION FOR QUESTIONS

Answers to certain frequently asked questions including the votes required for approval of the agenda items are included in this document beginning on page 55. For other questions, please see the following contact information:

For questions | ||

Regarding: | Contact: | |

Annual meeting or | Belden Investor Relations, 314-854-8054 | |

Executive Compensation Questions | ||

Stock ownership | American Stock Transfer & Trust Company | |

(Stockholders of Record) | http://www.amstock.com | |

800-937-5449 (within the U.S. and Canada) | ||

718-921-8124 (outside the U.S. and Canada) | ||

Stock ownership | Contact your broker, bank or other nominee | |

(Beneficial Owners) | ||

Voting | Belden Corporate Secretary, 314-854-8035 | |

| Belden Inc. | Page 1 |

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

Stockholder of Record

If your shares are registered directly in your name with Belden’s transfer agent, American Stock Transfer & Trust Company, you are considered (with respect to those shares) the stockholder of record and the Notice of Internet Availability of Proxy Materials is being sent directly to you by Belden. As thestockholder of record, you have the right to grant your voting proxy directly to Belden or to vote in person at the meeting.

Beneficial Owner

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered thebeneficial owner of shares held in “street name” (that is, the name of your stock broker, bank, or other nominee) and the Notice of Internet Availability of Proxy Materials is being forwarded to you by your broker or nominee who is considered, with respect to those shares, thestockholder of record. As the beneficial owner, you have the right to direct your broker or nominee how to vote and are also invited to attend the meeting. However, since you are not thestockholder of record, you may not vote these shares in person at the meeting.

Even if you plan to attend the annual meeting, we recommend that you also submit your proxy as described below so that your vote will be counted if you decide later not to attend the meeting.

|

| |||||

|

| |||||

|

|

| ||||

The Belden Board has ten members and four standing committees: Audit, Compensation, Finance and Nominating and Corporate Governance. The Board had sixfive meetings during 2013; two2015; one of which werewas telephonic. All directors attended 75% or more of the Board meetings and the Board committee meetings on which they served. The maximum number of directors authorized under the Company’s bylaws is currently ten. Mr. YoostKalnasy will not stand for reappointment to the Board and following the Annual Meeting, he will retire from the Board.Board in May 2016. The Board and the Company thank Mr. YoostKalnasy for his significant contributionsdistinguished service to Belden during his tenure.over the last three decades.

| Name of Director | Audit | Compensation | Finance | Nominating and Corporate Governance | Audit | Compensation | Finance | Nominating and Corporate Governance | ||||||||

David Aldrich | p | Chair | ||||||||||||||

Lance C. Balk | p* | p | Member | Chair | ||||||||||||

Steven W. Berglund | p | Member | ||||||||||||||

Judy L. Brown | p | p | Member | Member | ||||||||||||

Bryan C. Cressey | p | p | Member | Member | ||||||||||||

Glenn Kalnasy | p* | Member | ||||||||||||||

Jonathan Klein(4) | Member | |||||||||||||||

George Minnich | p* | Chair | ||||||||||||||

John M. Monter | p | p* | Member | Chair | ||||||||||||

John Stroup | ||||||||||||||||

Dean Yoost | p | |||||||||||||||

Meetings held in 2013 | 11 | 6 | 8 | 4 | ||||||||||||

Meetings held in 2015 | 11 | 4 | 5 | 4 | ||||||||||||

| (1) | Mr. Aldrich became the chair of the Compensation Committee in August 2015. |

| (2) | Mr. Balk rotated from the Nominating & Corporate Governance Committee to the Compensation Committee in November 2015. |

| (3) | Mr. Cressey serves as the chair of the Board. |

| (4) | Mr. Klein was appointed to the Board and the Nominating and Corporate Governance Committee in August 2015. |

| ||

At its regular meeting in March 2014,February 2016, the Board determined that each of the non-employee directors seeking reappointment meets the independence requirements of the NYSE listing standards. As part of this process, the Board determined that each such member had no material relationship with the Company.

Biographies of Directors Seeking Reappointment

Director Since:2007 Board Committees: • Compensation (Chair) | David J. Aldrich, | |||

Principal Occupation, Professional Experience and Educational Background: The Board recruited Mr. Aldrich based on his experience in high technology signal transmission applications and for his experience as a current Chief Executive Officer of a public company.

Mr. Aldrich received a B.A. degree in political science from Providence College and an M.B.A. degree from the University of Rhode Island. |

Director Since:2000 Board Committees: • Compensation • Finance (Chair) | Lance C. Balk, | |||

Principal Occupation, Professional Experience and In September, 2010, Mr. Balk was appointed as General Counsel of Six Flags Entertainment Corporation. Previously, Mr. Balk served as Senior Vice President and General Counsel of Siemens Healthcare Diagnostics from November 2007 to January 2010. From May 2006 to November 2007, he served in those positions with Dade Behring, a leading supplier of products, systems and services for clinical diagnostics, which was acquired by Siemens Healthcare Diagnostics in November 2007. Previously, he had been a partner of Kirkland & Ellis LLP since 1989, specializing in securities law and mergers and acquisitions. The Board originally recruited Mr. Balk based on his expertise in advising multinational public and private companies on complex mergers and acquisitions and corporate finance transactions. He provides insight to the Board regarding business strategy, business acquisitions and capital structure.

Mr. Balk received a B.A. degree from Northwestern University and a J.D. degree and an M.B.A. degree from the University of Chicago. |

| Belden Inc. 2016 Proxy Statement | Page 3 |

Director Since:2013 Board Committees: • Compensation | Steven W. Berglund, | |||

Principal Occupation, Professional Experience and Mr.

Prior to joining Trimble, Mr. Berglund was President of Spectra Precision, a group within Spectra Physics AB. Mr. Berglund’s business experience includes a variety of senior leadership positions with Spectra Physics, and manufacturing and planning roles at Varian Associates. He began his career as a process engineer at Eastman Kodak.

Mr. Berglund attended the University of Oslo and the University of Minnesota where he received a B.S. in chemical engineering. He received his M.B.A. from the University of Rochester and is the current chair of the board of directors of the Silicon Valley Leadership | ||||

Director Since:2008 Board Committees: • Audit • Finance | Judy L. Brown, | |||

Principal Occupation, Professional Experience and Educational Background: In recruiting Ms. Brown, the Board sought a member with international experience in finance and accounting to help the Company pursue its strategic global focus. As an employee of Ernst & Young for more than nine years in the U.S. and Germany, she provided audit and advisory services to U.S. and European multinational public and private companies. She served in various financial and accounting roles for six years in the U.S. and Italy with Whirlpool Corporation, a leading manufacturer and marketer of appliances. In 2004, she was appointed Vice President and Controller of Perrigo Company, a leading global healthcare supplier and the world’s largest manufacturer and marketer of over-the-counter pharmaceutical products sold under store brand labels. Since 2006, she has served as Executive Vice President and Chief Financial Officer of Perrigo.

She received a B.S. degree in Accounting from the University of Illinois; an M.B.A. from the University of Chicago; and attended the Aresty Institute of Executive Education of the Wharton School of the University of Pennsylvania. Ms. Brown also is a Certified Public Accountant. |

Director Since:1985 Chairman Board Committees: • Finance • Nominating and Corporate Governance | Bryan C. Cressey, | |||

Principal Occupation, Professional Experience and Educational Background: For the past twenty-nine years, Mr. Cressey has been a General Partner and Principal of Golder, Thoma and Cressey, Thoma Cressey Bravo, and Cressey & Company, all private equity firms, the last of which he founded in 2007. The firms have specialized in healthcare, software and business services. He is also a director of Select Medical Holdings Corporation, a healthcare services company, and several privately held companies. He was a director of Jazz Pharmaceuticals, a specialty pharmaceutical company until 2012. Mr. Cressey’s years of senior-level experience with public and private companies in diverse industries, his legal and business education and experience, and his regular interaction with the equity markets make him highly qualified to serve on the Company’s Board.

Mr. Cressey received a B.A. degree from the University of Washington and a J.D. degree and an M.B.A. degree from Harvard University. | ||||

Director Since:2015 Board Committees: • Nominating and Corporate Governance | Jonathan C. Klein, 58 | |||

Principal Occupation, Professional Experience and Educational Background: The Board recruited Mr. Klein for his extensive experience within the broadcast industry, more specifically his experience with programming, production, and over-the-top distribution models. Since 2012, Mr. Klein has served as the CEO and Co-Founder of TAPP Media, an over-the-top subscription video platform which operates paid channels build around personalities. From 2004 to 2010, he served as President of CNN leading the U.S. network to its highest ratings and profitability. Previously he had been the Founder and CEO of the FeedRoom, a pioneering online video aggregation site, developing new online advertising concepts which have become industry standards today. From 1996 to 1998 he served as Executive Vice President of CBS News, overseeing prime time programming and strategic planning for in-house studio productions. Mr. Klein attended Brown University where he received a B.A. in history. |

| Belden Inc. 2016 Proxy Statement | Page 5 |

Director Since:2010 Board Committees: • Audit (Chair) |

| |||

| George E. Minnich, | |||

Principal Occupation, Professional Experience and Educational Background: Mr. Minnich served as Senior Vice President and Chief Financial Officer of ITT Corporation from 2005 to 2007. Prior to that, he served for twelve years in several senior finance positions at United Technologies Corporation, including Vice President and Chief Financial Officer of Otis Elevator and of Carrier Corporation. He also held various positions within Price Waterhouse from 1971 to 1993, serving as an Audit Partner from 1984 to 1993. Mr. Minnich

Mr. Minnich received a B.S. degree in Accounting from Albright College. | ||||

Director Since:2004 Board Committees: • Audit • Nominating and Corporate Governance (Chair) | John M. Monter, | |||

Principal Occupation, Professional Experience and Educational Background: Mr. Monter served as a director of Belden 1993 Inc. During his career, Mr. Monter has served in the general management position for three companies, two manufacturers and a construction services company. Previous to his general management experience, Mr. Monter worked in several marketing and sales positions, including holding worldwide responsibilities in both marketing and sales for a multinational manufacturing company. His broad general management and sales and marketing experience at the policy-making level particularly qualifies him to serve on the Company’s Board.

From 1993 to 1996, he was President of the Bussmann Division of Cooper Industries, Inc. Bussmann is a multi-national manufacturer of electrical and electronic fuses, with ten manufacturing facilities in four countries and sales offices in most major industrial markets around the world. From 1996 through 2004, he was President and Chief Executive Officer of Brand Services, Inc. (“Brand”) and also a member of the board of directors of

Mr. Monter received a B.S. degree in journalism from Kent State University and an M.B.A. degree from the University of Chicago. |

| Page 6 | Belden Inc. 2016 Proxy Statement |

Director Since:2005 President and Chief Executive | John S. Stroup, | |||

Principal Occupation, Professional Experience and Educational Background: Mr. Stroup was appointed President, Chief Executive Officer and member of the Board effective October 31, 2005. His experience in strategic planning and general management of business units of other public companies, coupled with his in-depth knowledge of the Company, makes him an integral member of the Board and a highly

From 2000 to the date of his appointment with the Company, he was employed by Danaher Corporation, a manufacturer of professional instrumentation, industrial technologies, and tools and components. At Danaher, he initially served as Vice President, Business Development. He was promoted to President of a division of Danaher’s Motion Group and later to Group Executive of the Motion Group. Earlier, he was Vice President of Marketing and General Manager with Scientific Technologies Inc.

Mr. Stroup received a B.S. degree in mechanical engineering from Northwestern University and an M.B.A. degree from the University of California at Berkeley. Mr. Stroup is a director of RBS Global, Inc. RBS Global manufactures power transmission components, drives, conveying equipment and other related products under the Rexnord name. |

| Belden Inc. | Page |

The Audit Committee operates under a Board-approved written charter and each member meets the independence requirements of the NYSE’s listing standards. The Committee assists the Board in overseeing the Company’s accounting and reporting practices by, among other items:

meeting with its financial management and independent registered public accounting firm (Ernst & Young) to review the financial statements, quarterly earnings releases and financial data of the Company;

reviewing and selecting the independent registered public accounting firm who will audit the Company’s financial statements;

reviewing the selection of the internal auditors who provide internal audit services;

reviewing the scope, procedures and results of the Company’s financial audits, internal audit procedures, and internal controls assessments and procedures under Section 404 of the Sarbanes-Oxley Act of 2002 (“SOX”);

providing oversight responsibility for the process the Company uses in performing its periodic enterprise risk analysis; and

evaluating the Company’s key financial and accounting personnel.

At its March 4, 2014February 25, 2016 meeting, the Board determined that each of Ms. Brown and Mr. Minnich wasqualifies as an Audit Committee Financial Expert as defined in the rules pursuant to SOX andSOX. As previously described, each member of the Audit Committee is independent.

The Compensation Committee of Belden determines, approves and reports to the Board on compensation for the Company’s elected officers. The Committee reviews the design, funding and competitiveness of the Company’s retirement programs. The Committee also assists the Company in developing compensation and benefit strategies to attract, develop and retain qualified employees. The Committee operates under a written charter approved by the Board.

The Finance Committee provides oversight in the area of corporate finance and makes recommendations to the Board about the financial aspects of the Company. Examples of topics upon which the Finance Committee may provide guidance include capital structure, capital adequacy, credit ratings, capital expenditure planning and dividend policy and share repurchase programs. The Committee is governed by a written charter approved by the Board.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee identifies, evaluates, and recommends nominees for the Board for each annual meeting (and to fill vacancies during interim periods); evaluates the composition, organization and governance of the Board and its committees; oversees senior management succession planning; and develops and recommends corporate governance principles and policies applicable to the Company. The Nominating and Corporate Governance Committee will consider nominees recommended by stockholders if such nominations are submitted to the Company prior to the deadline for proposals as noted above under the caption “Nomination of Director Candidates.”Candidates” on page 58.

The Committee’s responsibilities with respect to its governance function include considering matters of corporate governance and reviewing (and recommending to the Board revisions to) the Company’s corporate governance guidelines and its code of ethics,conduct, which applies to all Company employees, officers and directors. The Committee is governed by a written charter approved by the Board.

| Page | Belden Inc. |

Corporate Governance Documents

Current copies of the Audit, Compensation, Finance and Nominating and Corporate Governance Committee charters, as well as the Company’s governance principles and code of ethics,conduct, are available on the Company’s website athttp://investor.belden.com/documents.cfminvestor-relations/corporate-governance/governance-documents/default.aspx. Printed copies of these materials are also available to stockholders upon request, addressed to the Corporate Secretary, Belden Inc., 1 North Brentwood Boulevard, 15th Floor, St.Saint Louis, Missouri 63105.

Related Party Transactions and Compensation Committee Interlocks

It is our policy to review all relationships and transactions in which the companyCompany and our directors and executive officers or their immediate family members are participants to determine whether such persons have a direct or indirect material interest. Annually, we obtain information from all directors and executive officers with respect to related person transactions to determine, based on the facts and circumstances, whether the Company or a related person has a direct or indirect material interest in any such transaction. As required under SEC rules, transactions that are determined to be directly or indirectly material to the Company or a related person are disclosed in our proxy statement. We have determined that there were no material related party transactions during 2013.2015.

None of our executive officers served during 20132015 as a member of the board of directors or as a member of a compensation committee of any other company that has an executive officer serving as a member of our Board of Directors or Compensation Committee.

The Company’s Board has established a process to receive communications from stockholders and other interested parties. Stockholders and other interested parties may contact any member (or all members) of the Board (including Bryan Cressey, Chairman of the Board and presiding director for non-management director meetings), any Board committee, or any chair of any such committee by U.S. mail, through calling the Company’s hotline or via e-mail.

To communicate with the Board, any individual director or any group or committee of directors, correspondence should be addressed to the Company’s Board or any such individual directors or group or committee of directors by either name or title. All such correspondence should be sent “c/o Corporate Secretary, Belden Inc.” at 1 North Brentwood Boulevard, 15th Floor, St.Saint Louis, MO 63105. To communicate with any of our directors electronically or through the Company’s hotline, stockholders should go to our corporate website athttp://investor.belden.com/documents.cfminvestor-relations/corporate-governance/governance-documents/default.aspx. On this page, you will find a section titled “Contact the Belden Board”, on which are listed the Company’s hotline number (with access codes for dialing from outside the U.S.) and an e-mail address that may be used for writing an electronic message to the Board, any individual directors, or any group or committee of directors. Please follow the instructions on our website to send your message.

All communications received as set forth in the preceding paragraph will be opened by (or in the case of the hotline, initially reviewed by) our corporate ombudsman for the sole purpose of determining whether the contents represent a message to our directors. The Belden Ombudsmanombudsman will not forward certain items which are unrelated to the duties and responsibilities of the Board, including: junk mail, mass mailings, product inquiries, product complaints, resumes and other forms of job inquiries, opinion surveys and polls, business solicitations, promotions of products or services, patently offensive materials, advertisements, and complaints that contain only unspecified or broad allegations of wrongdoing without appropriate information support.

In the case of communications to the Board or any group or committee of directors, the corporate ombudsman’s office will send copies of the contents to each director who is a member of the group or committee to which the envelope or e-mail is addressed.

In addition, it is the Company’s policy that each director attends the annual meeting absent exceptional circumstances. Each director other than Mr. Yoost attended the Company’s 20132015 annual meeting.

| Belden Inc. | Page |

Board Leadership Structure and Role in Risk Oversight

For some time, the Company has separated the Chief Executive Officer and Board Chairman positions. We believe this separation of roles is most appropriate for the Company and stockholders. Mr. Cressey, who is independent of management and the Company, provides strong leadership experience, strategic vision and an understanding of the risks associated with our business. Mr. Stroup, as CEO, provides strategic planning, general management experience, and in-depth knowledge of the Company, and, as a member of the Board, acts as an important liaison between management and the Company’s non-employee directors.

Our Board assesses on an ongoing basis the risks faced by the Company in executing its strategic plan. These risks include strategic, technological, competitive and operational risks. The Audit Committee oversees the process we use in performing our annual enterprise risk management (“ERM”) analysis (while the Board oversees the content of the analysis, management is responsible for the execution of the process and the development of the content).

Director Stock Ownership Policy

The Board’s policy requires that each non-employee director hold Company stock equal in value to five times his or her annual cash retainer (currently 5 times $68,000)$73,000). Upon appointment, a member has five years to meet this requirement, but must meet interim goals during the five-year period of: 20% after one year; 40% after two years; 60% after three years; and 80% after four years. The in-the-money value of vested stock options and the value of unvested RSUs are included in making this determination at the higher of their grant date value or current market value. Each non-employee director meets either the full-period or interim-period holding requirement: Ms. Brown and Messrs. Aldrich, Balk, Cressey, Kalnasy, Minnich and Monter each meet 100% of the stock holding requirement. Mr. Minnich, who was appointed in May 2010, and Mr. Yoost, who was appointed in March 2011, each meet the three-year interim requirement. Mr. Berglund, who was appointed in December 2013, doesmeets the two-year interim requirement. Mr. Klein, who was appointed in August, 2015, is not yet have an interimsubject to the minimum holdings requirement.

The following table reflects the director annual compensation structure as of December 31, 20132015 and as of May 1, 20142016 per changes approved by the Board at its December 2013February 2016 meeting:

| Description | As of December 31, 2013 ($) | As of May 1, 2014 ($) | Recipient(s) | As of December 31, 2015 ($) | As of May 1, 2016 ($) | Recipient(s) | ||||||

Cash Components | Cash Components | Cash Components | ||||||||||

| Basic Retainer | 68,000 | 71,000 | All except Stroup | 73,000 | 75,000 | All except Stroup | ||||||

| Audit Committee Chair | 11,000 | 11,500 | Minnich | 12,000 | 12,500 | Minnich | ||||||

| Other Committee Chair | 5,800 | 6,000 | Balk, Kalnasy and Monter | 6,250 | 6,500 | Aldrich, Balk and Monter | ||||||

| Audit Committee Service | 5,800 | 6,000 | Brown, Minnich and Yoost | 6,250 | 6,500 | Brown, Minnich and Monter | ||||||

| Multiple Committee Service | 5,800 | 6,000 | Balk, Brown, Cressey and Monter | 6,250 | 6,500 | Balk, Brown, Cressey and Monter | ||||||

| Non-Executive Chair | 37,500 | 39,000 | Cressey | 40,000 | 41,750 | Cressey | ||||||

| Equity Components | Equity Components | Equity Components | ||||||||||

| Restricted Stock Unit Grant | 126,000 | 131,000 | All except Stroup | 135,000 | 139,000 | All except Stroup | ||||||

| Additional Grant for Non-Executive Chair | 37,500 | 39,000 | Cressey | 40,000 | 41,750 | Cressey | ||||||

| Page | Belden Inc. |

In 2013, the Board, guided by industry data, approved an increase in compensation for the non-executive chair position, retroactive to January 1, 2012, of $75,000 per year, half of which was to be paid in cash and half of which was to be included in the annual equity grant. As illustrated above, this aggregate amount will increase to $78,000 as of May 1, 2014.

The following table provides information on non-employee director compensation for 2013.2015.

| Director | Fees Earned or ($) | Stock Awards(2) ($) | Option Awards(3) ($) | All Other Compensation(4) ($) | Total ($) | Fees Earned or Paid in Cash(1) ($) | Stock Awards(2) ($) | Option ($) | All Other ($) | Total ($) | ||||||||||||||||||||

David Aldrich | 67,000 | 125,982 | - | 768 | 193,750 | 74,937 | 134,988 | - | 362 | 210,287 | ||||||||||||||||||||

Lance C. Balk | 78,400 | 125,982 | - | 12,506 | 216,888 | 84,667 | 134,988 | - | 12,876 | 232,531 | ||||||||||||||||||||

Steven W. Berglund | 5,667 | 170,250 | - | - | 175,917 | 72,334 | 134,988 | - | 695 | 208,017 | ||||||||||||||||||||

Judy L. Brown | 78,400 | 125,982 | - | 768 | 205,150 | 84,667 | 134,988 | - | 362 | 220,017 | ||||||||||||||||||||

Bryan C. Cressey | 147,700 | 201,025 | - | 768 | 349,493 | 118,117 | 175,003 | - | 470 | 293,590 | ||||||||||||||||||||

Glenn Kalnasy | 72,700 | 125,982 | - | 768 | 199,450 | 75,896 | 134,988 | - | 362 | 211,246 | ||||||||||||||||||||

Jonathan Klein | 30,417 | 132,400 | - | - | 162,817 | |||||||||||||||||||||||||

George Minnich | 83,533 | 125,982 | - | 500 | 210,015 | 90,334 | 134,988 | - | 362 | 225,684 | ||||||||||||||||||||

John M. Monter | 78,400 | 125,982 | - | 768 | 205,150 | 90,834 | 134,988 | - | 362 | 226,184 | ||||||||||||||||||||

Dean Yoost | 72,700 | 125,982 | - | 1,101 | 199,783 | |||||||||||||||||||||||||

| (1) | Amount of cash retainer and committee fees. |

| (2) | As required by the instructions for completing this column “Stock Awards,” amounts shown are the grant date fair value of stock awards granted during |

| (3) |

| Amount of interest earned on deferred director fees and dividends paid on vested stock awards. |

ITEM I – ELECTION OF NINE DIRECTORS

The Company currently has ten directors – Ms. Brown and Messrs. Aldrich, Balk, Berglund, Cressey, Kalnasy, Klein, Minnich, Monter Stroup and Yoost.Stroup. The term of each director will expire at this annual meeting and the Board proposes that each of them (other than Mr. Yoost who will not stand for reelection)Ms. Brown and Messrs. Aldrich, Balk, Berglund, Cressey, Klein, Minnich, Monter and Stroup be reelected for a new term of one year and until their successors are duly elected and qualified. Mr. Kalnasy is retiring from the Board and is not seeking re-appointment. Each nominee has consented to serve if elected. If any of them becomes unavailable to serve as a director, the Board may designate a substitute nominee. In that case, the persons named as proxies will vote for the substitute nominee designated by the Board.

THE BELDEN BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE NOMINATED SLATE OF DIRECTORS.

| Belden Inc. | Page |

ITEM II – RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 20142016

It is anticipated that Ernst & Young LLP (“EY”) will be selected as our independent registered public accounting firm for the year ending December 31, 2014,2016, and the Board of Directors has directed that management submit the anticipated appointment for ratification by the stockholders at the annual meeting. Ernst & YoungEY has served as our registered public accounting firm since the 2004 merger of Belden Inc. and Cable Design Technologies Corporation, and prior to that served as Belden 1993 Inc.’s registered public accounting firm since it became a public company in 1993. A representative of the firm will be present at the annual meeting, will have an opportunity to make a statement, if they desire, and will be available to respond to appropriate questions.

We are not required to obtain stockholder ratification of the appointment of Ernst & YoungEY as our independent registered public accounting firm. However, we are submitting the appointment to stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the appointment, the Audit Committee will reconsider whether or not to retain Ernst & Young.EY. Even if the appointment is ratified, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time if they determine that such a change would be in our best interests and the best interests of our stockholders.

Fees to Independent Registered Public Accountants for 20132015 and 20122014

The following table presents fees for professional services rendered by EY for the audit of the Company’s annual financial statements and internal control over financial reporting for 20132015 and 20122014 as well as other permissible audit-related and tax services.

| 2013 | 2012 | 2015 | 2014 | |||||||||||||

Audit Fees | $ | 2,633,723 | $ | 2,691,710 | $ | 2,727,995 | $ | 3,117,076 | ||||||||

Audit-Related Fees | 265,349 | 475,082 | 0 | 543,295 | ||||||||||||

Tax Fees | 1,187,534 | 623,966 | 536,464 | 789,319 | ||||||||||||

All Other Fees | 0 | 0 | 0 | 0 | ||||||||||||

Total EY fees | $ | 4,086,606 | $ | 3,790,758 | $ | 3,264,459 | $ | 4,449,690 | ||||||||

“Audit fees” primarily represent amounts paid or expected to be paid for audits of the Company’s financial statements and internal control over financial reporting under SOX 404, review of SEC comment letters, reviews of SEC Forms 10-Q, Form S-8, Form 10-K and the proxy statement, and statutory audit requirements at certain non-U.S. locations.locations, and comfort letter procedures related to debt issuances.

“Audit-related fees” are primarily related to due diligence services on completed and potential acquisitions.

“Tax fees” for 20132015 and 20122014 are for domestic and international compliance totaling $132,746$186,377 and $95,053,$258,507, respectively, and tax planning totaling $1,054,788$350,087 and $528,913,$530,812, respectively.

In approving such services, the Audit Committee did not rely on the pre-approval waiver provisions of the applicable rules of the SEC.

Audit Committee’s Pre-Approval Policies and Procedures

Audit Fees:For 2013,2015, the Committee reviewed and pre-approved the audit services and estimated fees for the year. Throughout the year, the Committee received project updates and if appropriate, approved or ratified any amounts exceedingthat significantly exceeded the original estimates.estimates, if any.

| Page | Belden Inc. |

Audit-Related and Non-Audit Services and Fees:Annually, and otherwise as necessary, the Committee reviews and pre-approves all audit-related and non-audit services and the estimated fees for such services. For recurring services, such as tax compliance and statutory filings, the Committee reviews and pre-approves the services and estimated total fees for such matters by category and location of service. The projected fees are updated quarterly and the Committee considers and, if appropriate, approves any amounts exceeding the original estimates.

For non-recurring services, such as special tax projects, due diligence, or other tax services, the Committee reviews and pre-approves the services and estimated fees by individual project. Up to an approved threshold amount, the Committee has delegated approval authority to the Committee Chair. The cost projections

For both recurring and non-recurring services, the projected fees are updated quarterly and the Committee reviews,considers and, if appropriate, approves any amounts exceeding the original estimates.

Should an engagement need pre-approval before the next Committee meeting, the Committee has delegated to the Committee Chair authority to grant such approval up to an approved spending threshold. Thereafter, the entire Committee will review such approval at its next quarterly meeting.

The Audit Committee assists the Board in overseeing various matters, including: (i) the integrity of the Company’s financial statements; (ii) all material aspects of the Company’s financial reporting, internal accounting control, and audit functions; (iii) the qualifications and independence of the independent auditors; and (iv) the performance of the Company’s internal audit function and independent auditors.

The Audit Committee’s oversight includes reviewing with management the Company’s major financial risk exposures and the steps management has taken to monitor, mitigate, and control such exposures. Management has the responsibility for the implementation of these activities and is responsible for the Company’s internal controls, financial reporting process, compliance with laws and regulations, and the preparation and presentation of the Company’s financial statements.

Ernst & Young LLP (“EY”), the Company’s registered public accounting firm for 2013,2015, is responsible for performing an independent audit of the consolidated financial statements and an audit of the effectiveness of the Company’s internal control over financial reporting in accordance with the standards of the Public Company Accounting Oversight Board (U.S.) (“PCAOB”) and issuing reports with respect to these matters, including expressing an opinion on the conformity of the Company’s audited financial statements with generally accepted accounting principles.

In connection with the Company’s December 31, 20132015 financial statements, the Committee: (i) has reviewed and discussed the audited financial statements with management (including management’s assessment of the effectiveness of the Company’s internal control over financial reporting and EY’s audit of the Company’s internal control over financial reporting for 2013)2015); (ii) has discussed with EY the matters required to be discussed under current auditing standards;PCAOB Auditing Standard No. 16,Communications with Audit Committees; and (iii) has received and discussed with EY the written disclosures and letter from EY required by the PCAOB Ethics and Independence Rule 3526,Communication with Audit Committees Concerning Independence, and has discussed with EY theirits independence from the Company.

As part of such discussions, the Committee has considered whether the provision of services provided by EY, not related to the audit of the consolidated financial statements and internal control over financial reporting referred to above or to the reviews of the interim consolidated financial statements included in the Company’s quarterly reports on Form 10-Q, is compatible with maintaining EY’s independence. (Above is a report on audit fees, audit-related fees, tax fees, and taxother fees the Company paid EY for services performed in 20132015 and 2012.2014.) The Committee has concluded that EY’s provision of non-audit services to the Company and its subsidiaries is compatible with theirits independence.

| Belden Inc. | Page |

Based on these reviews and discussions, the Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for 2013.2015.

Audit Committee

George E. Minnich (Chair)

Judy L. Brown

Dean YoostJohn M. Monter

THE BELDEN BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RATIFICATION OF ERNST & YOUNG AS THE COMPANY’S INDEPENDENT REGISTERED ACCOUNTING FIRM.FIRM FOR 2016.

| Page | Belden Inc. |

EQUITY COMPENSATION PLAN INFORMATION ON DECEMBER 31, 2013

| Plan Category | A | B | C | |||||||||||||||||

| Number of Securities to be Issued Upon Exercise of Outstanding Options | Weighted Average Exercise Price of Outstanding Options | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column A) | ||||||||||||||||||

Equity Compensation Plans Approved by Stockholders(1) | 1,667,880 | (2 | ) | 36.3784 | 3,006,911.50 | (3 | ) | |||||||||||||

Equity Compensation Plans Not Approved by Stockholders | - | - | - | |||||||||||||||||

Total | 1,667,880 | 3,006,911.50 | ||||||||||||||||||

|

|

|

| |||||||||||||||||

Section 16(a) Beneficial Ownership Reporting Compliance

Based upon a review of filings with the Securities and Exchange Commission and other reports submitted by our directors and officers, we believe that all of our directors and executive officers complied during 2013 with the reporting requirements of Section 16(a) of the Securities Exchange Act of 1934.

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows the amount of Belden common stock beneficially owned (unless otherwise indicated) by our directors, the executive officers named in theSummary Compensation Table below and the directors and executive officers as a group. Except as otherwise noted, all information is as of April 4, 2014.

BENEFICIAL OWNERSHIP TABLE OF DIRECTORS, NOMINEES AND

EXECUTIVE OFFICERS

| Name | Number of Shares Beneficially Owned(1)(2) | Acquirable Within 60 Days(3) | Percent of Class Outstanding(4) | |||||||||

David Aldrich | 27,725 | - | * | |||||||||

Lance Balk | 79,329 | - | * | |||||||||

Steven W. Berglund | 2,500 | - | * | |||||||||

Kevin Bloomfield | 15,168 | 104,188 | * | |||||||||

Judy L. Brown | 25,692 | - | * | |||||||||

Bryan C. Cressey | 157,282 | - | * | |||||||||

Henk Derksen | 14,557 | 59,752 | * | |||||||||

Christoph Gusenleitner | 11,704 | 29,568 | * | |||||||||

Glenn Kalnasy | 31,108 | 1,000 | * | |||||||||

George Minnich | 16,457 | - | * | |||||||||

John M. Monter(5) | 80,220 | - | * | |||||||||

John Stroup | 168,130 | (6) | 334,806 | (7) | * | |||||||

Dhrupad Trivedi | 7,436 | 4,045 | * | |||||||||

| Dean Yoost | 14,970 | - | * | |||||||||

| All directors and executive officers as a group (18 persons) | 694,700 | 653,961 | 1.16 | % | ||||||||

BENEFICIAL OWNERSHIP TABLE OF STOCKHOLDERS OWNING MORE THAN FIVE PERCENT

The following table shows information regarding those stockholders known to the Company to beneficially own more than 5% of the outstanding Belden shares as of December 31, 2013.

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

Compensation Discussion and Analysis (“CD&A”)

A NOTEFROMTHE BELDEN COMPENSATION COMMITTEE

Valued Belden Stockholders:

The Committee would like to thank Belden’s stockholders for another year of loyal support in 2013.2015. For the secondfourth consecutive year, our Say-on-Pay proposal was supported by over 97% of the voted shares. This illustrates to us that: (1) the stockholders understand and support the Company’s strategy, (2) the stockholders believe in the management team and agree that the compensation structure is well aligned with Company strategy and (3) thatthe stockholders believe in the management team and there is an open line of communication between management and stockholders. Continuous engagement with the investment community is a top priority for Belden management and our consistent Say-on-Pay support signals to us that management is executing well on this priority.

2013That being said, 2015 was an importanta challenging year of transition at Belden. The integration of two major 2012 acquisitions coupledfor U.S. multinational management teams. For Belden in particular, in a year that began with the transitionsuccessful completion of the strategically significant Tripwire acquisition, the focus was quickly redirected. The simultaneous strengthening of the U.S. dollar and decline in oil prices impacted demand environment within several end markets. Additionally, softness with advertising spend, a source of revenue to our broadcast customers led to a new operating platform structure requiredtemporary pause in capital spending within the industry. Overall, the diverse portfolio and the ability of the management team to quickly recognize and react to these challenges allowed Belden navigate these challenges well. The effectiveness of the Belden business system is reflected in the record EBITDA margins and strong leadership. The factshare capture in a year which many peers reacted too late.

We acknowledge, however, the impact that the Company balanced these changes with strong executionmarket disruptions had on equity prices in 2015. Challenging market conditions are the marketplace is a testament to the team that John Stroup has assembled and the business systems they have put in place over the past eight years. The investment community’s endorsementtrue test of the strategy and performance are reflected in valuations not previously seen at Belden, and we strive to build upon the trust provided by current and prospective stockholders.

We understand, however, that successful times can test a compensation program as much as challenging times. We are acutely aware that as the equity prices increase, we need to ensure that our management remains properly engaged and motivated.program’s design. We believe that the longBelden program is performing appropriately in these circumstances. The shorter term focuscash incentive plan allowed us to reward accomplishments against pre-determined objectives in areas that reflect the underlying health of incentive programsthe business. On the other hand, the longer term incentives provided to our executives will be successfulonly result in motivatingrealizable compensation if our leadersstockholders likewise benefit from significant stock price appreciation. It is noteworthy that of the compensation shown in the Summary Compensation Table below, 68.9% of the compensation disclosed for our CEO and 56.3% for the NEOs as a whole is composed of equity grants without any current value. However, the three-year measurement period for the performance stock units and the ten-year life of the stock appreciation rights will properly incentivize the team to drive even more value creation well into the future. We hopeperformance needed to maximize stockholder value. On that after reviewingbasis and the remainder of the materials that follow, we believe that you will continue to agree that we are doing our job of aligning pay with performance.

Therefore, we request your support for Belden’s 2016 Say-on-Pay proposal and the other compensation related proposals contained in this year.document. If at any time you would like to discuss the compensation program, Belden management iswe are available to address your questions. Thank you for your consideration.

The Belden Inc. Compensation Committee

DAVID ALDRICH, CHAIR | LANCE BALK | STEVE BERGLUND | GLENN KALNASY |

In this section, we discuss our compensation program as it pertains to our chief executive officer, our chief financial officer, and our three other most highly compensated executive officers who were serving at the end of 2013.2015. We refer to these five persons throughout as the “named executive officers” or our “NEOs.”“NEOs”.

| Belden Inc. 2016 Proxy Statement | Page 15 |

For 2013,2015, our named executive officers were:

John Stroup | President and Chief Executive Officer | |

Henk Derksen | Senior Vice President, Finance, and Chief Financial Officer | |

| Executive Vice President, Enterprise Solutions | |

Ross Rosenberg | Senior Vice President, | |

| Executive Vice President, | |

|

As noted by our Compensation Committee above, 20132015 was an excitingmarked by steady performance despite a mixed macroeconomic environment. We began the year at Belden. 2012 closedby successfully completing the acquisition of Tripwire, a cybersecurity asset that we will be able to leverage across all of our served markets as demand for security in connected applications continues to increase. As we made our way through the first half of 2015, it became clear that lower oil prices and a stronger US dollar would impact the demand from several end markets within the Broadcast and Industrial platforms. Despite these impediments, the business as a whole performed well, with four second-half M&A transactionsstrong performance in our enterprise solutions, broadband connectivity and plansnetwork security businesses. Productivity improvement programs during the year will allow Belden to transition into a new reporting structurecontinue to protect, and in 2013. The acquisitions of Miranda Technologies and PPC Broadband were integrated successfully and at the beginning of April we began reporting results as four global business platforms: Industrial Connectivity Solutions, Industrial IT Solutions, Enterprise Connectivity Solutions and Broadcast Solutions.some platforms expand, its margin profile. Some financial highlights of the consolidated business included:included the following (see the Company’s Form 8-K filed on February 9, 2016 for a reconciliation of GAAP financial measures to non-GAAP measures):

A total stockholder return for 2013Record adjusted revenues of 57.1%.

Over a 12%Adjusted gross profit margins of 41.6%, an increase in revenues, both on a GAAP and an adjusted basis.

The distributionRecord adjusted earnings per share of $4.98, an increase of 17.7% over $100 million to stockholders in the form of dividends and our share repurchase program.

The Company’s 20132015 overall financial results and the individual performance of our NEOs are discussed underAnnual Cash Incentive Plan Awards beginning on page 27.21.

Some of the compensation-related highlights since our last proxy statement include:

The Company again employed two six-month periodsa full year period for the establishment of performance targets under our annual cash incentive program (“ACIP”). This allowed management to set second half targets that kept our associates properly incentivized to deliver a solid close versus the two six-month periods employed in recent years.

|

Under this new GICS code,performance stock unit awards granted under the Company’s three-year average equity award burn rate of 1.52% is far below the 5.49% burn rate cap established by Institutional Shareholder Services Inc.long term incentive plan (“ISS”LTIP”).

In our continual effortsPerformance measurement period extended from one year to employ best practices, the Compensation Committee implemented the following changesthree years.

These new features enhanced a compensation program, which already had the following stockholder-friendly components:

No tax gross-ups on perquisites andPerquisite-light compensation structure with no change-in-control-related excise tax gross-ups in employment agreements entered into in or after January 1, 2010.

Double trigger change-in-control provisions for severance provisions in employment agreements.

No history of option repricing or cash buyouts of underwater options.

| Page 16 | Belden Inc. 2016 Proxy Statement |

Equity plans do not have evergreen share authorizations and do not allow for aggressive share recycling.

Robust director and officer ownership guidelines, including six times annual base salary for the Chief Executive Officer.

No guaranteed ACIP or LTIP awards for officers. Both plans also contain award caps.

The Chief Executive Officer’s maximum ACIP payout is capped at 200% of target.III. 20132015 Say-on-Pay Review

For the secondfourth consecutive year, our executive compensation program was endorsed by a vast majority of our stockholders. With 94.58%93.98% of our shares voting on the issue, we received 97.77%99.04% in favor of the proposal, with only 0.56%0.93% opposing and 1.67%0.01% abstaining. We believe this is a reflection of the transparency of our program, which is clearly aligned with the interests of our stockholders. Based on this strong endorsement, we only made minor improvements to the existing program.

IV. Compensation Objectives and Elements

Belden’s executive compensation program is designed to support the interests of stockholders by rewarding executives for achievement of the Company’s specific business objectives, which for the NEOs in 2013 were2015 included net income from continuing operations, EBITDA, share capture, operating incomeworking capital turns and share capture.inventory turns. The overarching principles of the program are:

Maximizing stockholder value by allocating a significant percentage of compensation to performance-based pay that is dependent upon achievement of the Company’s performance goals, without encouraging excessive or unnecessary risk taking.

Aligning executives’ interests with stockholder interests by providing significant stock-based compensation and expecting executives to hold the stock they earn in compliance with our ownership guidelines.

Attracting and retaining talented executives by providing competitive compensation opportunities.

Rewarding overall corporate results while recognizing individual contributions.

| Belden Inc. | Page |

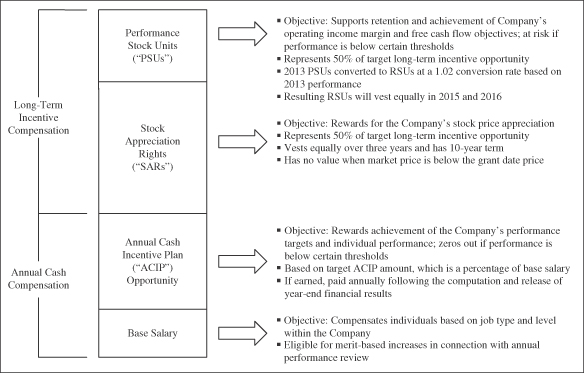

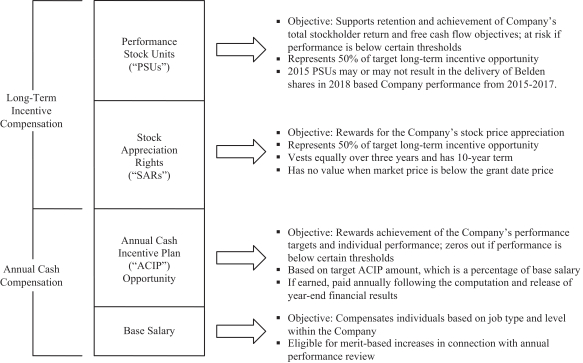

Below is an illustration of Belden’s compensation program. Individual compensation packages and the mix of base salary, annual cash incentive opportunity and long-term equity incentive compensation for each NEO varies depending upon the executive’s level of responsibilities, potential, performance and tenure with the Company. Each of the elements shown below is designed for a specific purpose, with the overall goal of achieving a high and sustainable level of Company and individual performance. The percentage of total compensation that is performance-based and therefore at risk generally increases as an officer’s level of responsibilities increases. Approximately 83%85% of Mr. Stroup’s 20132015 summary compensation table compensation was performance-based compensation, up from 73%compared to 79% in 2014 and 83% for 2012.2013. The chart below is not to scale for any particular named executive officer.

Additionally, the Company provides competitive retirement and benefit programs to our NEOs on the same basis as other employees and limited perquisites as described underCompensation Policies and Other Considerations.

C. Pay for Performance Philosophy

Our ability to execute on our strategic plan relies on implementation of our talent management program. We continually seek to hire and retain high performing and high potential managers to both drive performance today and build a dependable bench of successors for the future. This philosophy includes both compensating these managers well when we achieve our performance goals as well as placing large portions of management compensation at risk if the Company underperforms.so we do not pay for underperformance.

We believe that this philosophy has provided an appropriate balance to drive continuous improvement while retaining high performers through challenging times. More importantly, we believe the incentives we provide for achievement without rewarding under-performance aligns the interests of our managers closely with those of our investors, which is the main objective.

| Page | Belden Inc. |

Role of Compensation Consultant

Following an analysis based on rules promulgated by the NYSE, the Compensation Committee has retained Deloitte Consulting LLP (“Deloitte”Deloitte Consulting”) as its independent compensation consultant. Deloitte reports directly to the Committee. The Committee generally relies on Deloitte to provide it with comparison group benchmarking data and information as to market practices and trends, and to provide advice on key Committee decisions.

In 2013,2015, Deloitte Consulting provided advice to the Compensation Committee and management in connection with a proposed new long-term incentive compensation program, the composition of peer companies we use for benchmarking purposes, the design of our annual cash incentive and long-term incentive programs, and our executive employment agreements. For theirits compensation consulting in 2013,2015, we paid Deloitte $178,084.Consulting $162,797.

In 2013,2015, our financial management separately engaged affiliates of Deloitte Consulting to perform other services involving internal controls auditing, tax consulting and acquisition due diligence. For these non-compensation related services, we paid Deloitte $1,595,001.$2,988,411. The Compensation Committee did not approve these charges prior to their incurrence, but considered them in connection with Deloitte’sDeloitte Consulting’s retention for 2014.2016. Given the nature and scope of these other services, the Compensation Committee does not believe this work had any impact on the independence of our independent consultant.

Benchmarking and Survey Data

In determining total compensation levels for our NEOs, the Compensation Committee reviews market trends in executive compensation and a competitive analysis prepared by Deloitte Consulting, which compares our executive compensation to both the companies in the comparator group described below and to broader market survey data. The Committee also considers other available market survey data on executive compensation philosophy, strategy and design. The Company’s compensation philosophy is to target base salaries at the 50th percentile of the competitive market. Individual executives may have base salaries above or below the target based on their individual performances, internal equity and experience. As discussed above, at-risk incentive compensation components have the potential to reward our executives at levels above industry medians, but only when the Company is outperforming the industry.

The Committee chose our comparator group from companies in the primary industry segments in which the Company operates and competes for talent.

The comparator group companies for 20132015 were as follows:

Acuity Brands, Inc. | Curtiss-Wright Corporation | |||

Amphenol Corporation | General Cable Corporation | |||

Anixter International Inc. | Hexcel Corporation | |||

A.O. Smith Corporation | Hubbell Incorporated | |||

Carlisle Companies Incorporated | IDEX Corporation |

Molex Incorporated was acquired at the end of 2013 and will not be in the comparator group for 2014.

ISS and Glass-Lewis now both independently develop and publish peer groups that they use to analyze our compensation. It is noteworthy that of the 1514 companies in our comparator group, 1312 were chosen by ISS, Glass-Lewis, or both, as appropriate peer companies. The Committee considers the comparator group competitive pay analysis and survey data as simply non-determinative data points in making its pay decisions. The approach to pay decisions is not formulaic and the Committee, based on advice from Deloitte Consulting, exercises judgment in making them.

Each year, the Committee reviews the performance evaluations and pay recommendations for the named executive officers and the other senior executives. The Compensation Committee, with input from the Board, meets in executive session without the CEO present to review the CEO’s performance and set his compensation.

In its most recent review in March 2014,February 2016, the Committee concluded that the total direct compensation of executive officers, with respect to compensation levels, as well as structure, remainedare consistent with our compensation design and objectives.

| Belden Inc. 2016 Proxy Statement | Page 19 |

V. 20132015 Compensation Analysis

Salaries of executive officers are reviewed annually and at the time of a promotion or other change in responsibilities. Increases in salary are based on a review of the individual’s performance, the competitive market, the individual’s experience and internal equity. For executives who earn a composite individual performance score of 3 or more, base salaries may be adjusted using a merit salary increase matrix, discussed below. An executive who scores less than 3 and fails to improve his or her performance may be subject to disciplinary action, including dismissal.

The executive is scored on our merit salary increase matrix that is annually reviewed and, if appropriate, revised to reflect the competitive market based on the salary survey data noted above. The Committee reviews the merit budget and salary increase matrix. The executive’s salary is classified based on three categories: below market, market and above market. Company-wide, the ranking system is designed to take the form of a normal distribution, as follows:

1 – Least Effective – At least 5% of workforce

2 – Needs Improvement – At least 10% of workforce

3 – Effective-Consistently Meets Expectations – 50% to 70% of workforce

4 – Highly Valued – Combined with ‘5’, no more than 15% of workforce

5 – Exceptional – No more than 5% of workforce

20132015 Merit Increase Guidelines for U.S. Employees (including all of the Named Executive Officers)Officers

| Current Salary | Current Salary as a % of Midpoint | 1 Least | 2 Needs | 3 Effective | 4 Highly | 5 Exceptional | Current Salary as a % of Median | 1 Least | 2 Needs | 3 Effective | 4 Highly | 5 Exceptional | ||||||||||||||||||||||||||||||||

Above Market | 106-120 | % | 0 | % | 0 | % | 0-2 | % | 2-4 | % | 3-5 | % | Above 105% | 0 | % | 0 | % | 0-2 | % | 2-4 | % | 3-5% | ||||||||||||||||||||||

At Market | 95-105 | % | 0 | % | 0 | % | 0-3 | % | 4-6 | % | 6-8 | % | 95-105% | 0 | % | 0 | % | 0-3 | % | 4-6 | % | 6-8% | ||||||||||||||||||||||

Below Market | 80-94 | % | 0 | % | 0 | % | 3-5 | % | 6-8 | % | 8-10 | % | Below 95% | 0 | % | 0 | % | 3-5 | % | 6-8 | % | 8-10% | ||||||||||||||||||||||

The timing and amount of any salary adjustment will be based on the executive’s annual overall performance ranking and whether the executive falls “below,” “at” or “above” market as compared to the median of the applicable surveymarket data noted above.

For example, an executive with an overall ranking of “5” who is “above market” will receive a lower salary increase than an executive with a ranking of “5” who is “below market”.

The named executive officers’ salaries as of December 31, 2015 are provided in the following table:

| Name | Annual Base Salary at December 31, 2015 | |||

Mr. Stroup | $ | 850,000 | ||

Mr. Derksen | $ | 490,740 | ||

Mr. Pennycook | $ | 360,500 | ||

Mr. Rosenberg | $ | 389,890 | ||

Mr. Vestjens | $ | 374,500 | ||

| Page | Belden Inc. |

The named executive officers’ salaries are provided in the following table (salary for Mr. Gusenleitner was converted from Euros to U.S. dollars based on a one-year average exchange rate ending on December 31, 2013):

| ||

| ||

| ||

| ||

|

B. Annual Cash Incentive Plan Awards

Executive officers participate in our annual cash incentive plan. Overall, we had 1,5801,935 employees participate in the plan’s 20132015 performance offering. Under the plan, participants earn cash awards based on the achievement of Company and individual performance goals. For 2013,2015, the amount paid under the plan to all participants was approximately $18.5$22.0 million or approximately 7%6.7% of adjusted net income before ACIP expense. This compares to approximately 7%7.7%, 8%7.3%, 7.2% and 12%8.1% in 2014, 2013, 2012 2011 and 2010,2011, respectively, as shown below:

| (Dollar amounts in thousands) | 2013 | 2012 | 2011 | 2010 | 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||

(Adjusted) Net Income | $165,139 | $128,630 | $114,345 | $84,605 | ||||||||||||||

Adjusted Net Income | $213,722 | $186,167 | $165,139 | $128,630 | $114,345 | |||||||||||||

| Tax effected ACIP Expense (assuming 30% rate) (a) | $12,984 | $9,909 | $10,084 | $11,032 | $15,400 | $15,527 | $12,984 | $9,909 | $10,084 | |||||||||

| Adjusted Net Income Before ACIP Expense (b) | $178,123 | $138,539 | $124,429 | $95,637 | $229,122 | $201,694 | $178,123 | $138,539 | $124,429 | |||||||||

Reflected as a percentage (a divided by b) | 7.29% | 7.15% | 8.10% | 11.54% | 6.72% | 7.70% | 7.29% | 7.15% | 8.10% | |||||||||

| Form 8-K in which adjusted net income is reconciled to GAAP net income | February 6, 2014 | February 7, 2013 | N/A | February 3, 2011 | February 9, 2016 | February 5, 2015 | February 6, 2014 | February 7, 2013 | N/A | |||||||||

A participant’s award (other than the CEO) is computed using the following formula:

ACIP Award = Base Salary X Target Percentage X Financial Factor X Personal Performance Factor

In 2012, based on the fact that Mr. Stroup’s personal performance factor (“PPF”) had consistently been equal to or greater than 1.0, the Compensation Committee removed the component from the calculation of Mr. Stroup’s ACIP award. The Committee desired to avoid any perception that the PPF was simply serving as a second multiplier to Mr. Stroup’s award. Given his direct reporting relationship to the Board, the Committee is comfortable that Mr. Stroup is accountable without the need of the additional lever to adjust his ACIP award downward or upward.

Target Percentages

For 2013,2015, each NEO’s ACIP Target Percentages were as follows: Mr. Stroup – 130%, Mr. Derksen – 75% and Messrs. Derksen, Bloomfield, GusenleitnerPennycook, Rosenberg and TrivediVestjens – 70%.

| Belden Inc. 2016 Proxy Statement | Page 21 |

Financial Factors

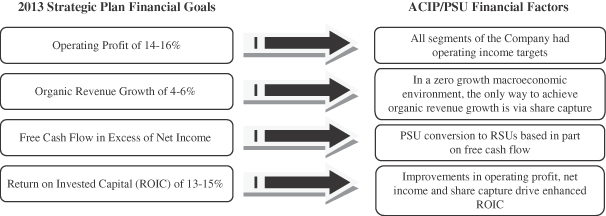

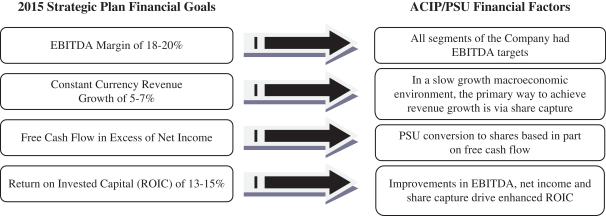

As stated above, performance targets for calculating the Financial Factors were based on net income from continuing operations, EBITDA, share capture, operating incomeworking capital turns and share capture.inventory turns. In addition, as discussed further below, the performance stock units (“PSUs”) had performance targets based on operating income marginrelative total stockholder return and free cash flow. In order to ensure that we are rewarding performance that drives stockholder value, these factors flow from and support the strategic financial goals we communicate to our investors.

Performance Factor Determination and Adjustments

The performance factors we use that make up the Financial Factor support our short- and long-range business objectives and strategy. We have selected multiple factors because we believe no one metric is sufficient to capture the performance we are seeking to achieve and any one metric in isolation may not promote appropriate management performance. Management and the Board continue to believe that net income from continuing operations isand EBITDA are the financial metricmetrics most clearly aligned with the enhancement of stockholder value. Therefore, it is weighed the mostthey are weighted heavily as ain our consolidated performance target. However, as shown above, operating income is a metric important to how our investors view us. It was therefore added as a component of the consolidated Financial Factor for 2011. New for 2013 wasand platform targets. Additionally, share capture which strips away all of the macroeconomic and inorganic impactscontinues to our revenue growth and presents a cleanbe an important measure of our performance versus our competitors.

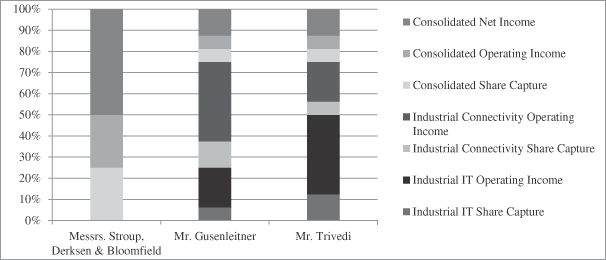

Because And despite the maturity of the impending changeour development from a Lean manufacturing standpoint, continuous improvement in reporting structure at the beginning of the second quarter, the decision was made to measure all of the executive officers based on consolidated thresholdsinventory and targets for the first half of the year. For the second half, the officers with company-wide responsibilities (Messrs. Stroup, Derksen and Bloomfield) continued to be measured using consolidated metrics. As the leaders of the two industrial product platforms, Mr. Gusenleitner and Mr. Trivedi shareworking capital turnover remains a common sales force and target many of the same customers. Therefore, their compensation components were interlinked. Mr. Gusenleitner is compensated 25% based on consolidated performance, 50% based on his Industrial Connectivity platform and 25% based on Mr. Trivedi’s Industrial IT platform. Similarly, Mr. Trivedi is compensated 25% based on consolidated performance, 50%

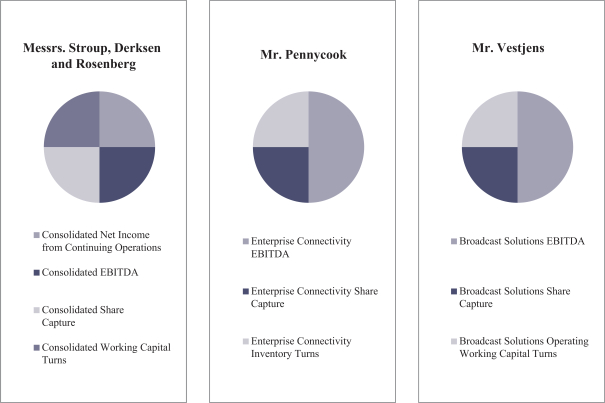

based on his Industrial IT platform and 25% based on Mr. Gusenleitner’s Industrial Connectivity platform. The applicable factors and weighting percentages are set prior to each performance period as shown in the chart below.

In setting performance goals, we consider our annual and long-range business plans and factors such as our past variance to targeted performance, economic and industry conditions, and our industry performance. We set challenging, realistic goals that will motivate performance within the top quartile of our comparator group.group based on consensus data on the peer companies publicly available at the time the targets are set. We recognize that the metrics may need to change over time to reflect new priorities and, accordingly, review these performance metrics at the beginning of each performance period.

In the first half of 2013,2015, thresholds, targets and targets ofmaximum levels for the performance factors that make up the Financial FactorFactors were set to challenge management to grow the company in a low growth environment. They were also set to account forFor instance, the fact that 2013 would include a full year’s results from Miranda and PPC. The first half 20132015 target for the consolidated net income from continuing operations componentreflected a 30% increase over actual 2014 performance. Likewise, the consolidated share capture target represented an almost 68% improvement over actual 2014 performance. Targets for the business platforms reflected similar stretch improvement initiatives. While platform performance on EBITDA and working capital/inventory turns did not fully meet our expectations, outperformance on share capture was achieved at the platform and consolidated levels. We view this as a positive result of our Belden Market Delivery System.

| Page 22 | Belden Inc. 2016 Proxy Statement |

Officers with company-wide responsibilities (Messrs. Stroup, Derksen and Rosenberg) were measured using consolidated performance. Mr. Pennycook and Mr. Vestjens were compensated based on the performance of the Financial Factor (annualized) was over 20% higher than the actualEnterprise Connectivity Solutions and Broadcast Solutions platforms, respectively. The applicable factors and weighting percentages are set prior to each performance in 2012. Likewise, the annualized target for consolidated operating income was approximately 35% in excess of actual 2012 performance. The share capture targets were set at a level to achieve Similarly, the second half platform level thresholds and targets were set at levels that, if achieved, would reflect noticeably improved performance. The second half consolidated net income and operating income targets were 5% and 8% greater than the actual first half performance, reflective of the desire to close the year strongly. The share capture metric was maintained at a steady rate and most parts of the business excelled in this areaperiod as shown in the second half of the year.chart below and illustrated in further detail onAppendix I.

Consistent with the terms of the annual cash incentive plan, the performance factors were adjusted to reflect certain unusual events that occurred during the year. These adjustments can result in either increases or decreases in performance factors and in 20132015 primarily concerned amortization of intangible assets, deferred gross profit adjustments, restructuring of the Company’s operations, purchase accounting effects of acquisitions, restructuring of the Company’s operations,depreciation expense, as well as somethe income tax impact of these adjustments. The Compensation Committee and the Audit Committee meet jointly to analyze and approve the adjustments recommended by management. The Committees believedagree that it was appropriate to adjust the financial results for these matters to properly capture our operating results and to eliminate the potential for managers delaying strategic decisions beneficial to the Company in the long term (e.g., restructuring) because of the impact of those decisions on short-term financial metrics or to benefit from favorable one-time adjustments.adjustments or unbudgeted events (such as acquisitions).